The Polymarket election phenomenon of 2024 fundamentally changed how the world consumes political data, proving that skin in the game forecasting often outperforms traditional polling. As we analyze the meteoric rise of this platform, it becomes clear that the Polymarket election cycle was not just a betting event, but a stress test for the concept of decentralized truth.

This guide serves as the ultimate resource for understanding Polymarket from its technical architecture and regulatory battles to its profound impact on global finance and politics.

Part 1: What is Polymarket?

The Evolution of Prediction Markets

Polymarket is the world’s largest decentralized prediction market. Built on the Polygon blockchain (a Layer 2 scaling solution for Ethereum), it allows users to buy and sell shares in the outcome of future events. Unlike a traditional sportsbook where you bet against a “house” that sets the odds, Polymarket is an order book exchange (and previously an Automated Market Maker) where prices are determined strictly by supply and demand.

The core philosophy of Polymarket is based on the Efficient Market Hypothesis. The idea is that if you incentivize people with money to be right, the collective intelligence of the market will aggregate all available information insider knowledge, public data, and expert analysis into a single, accurate probability.

How Pricing Works

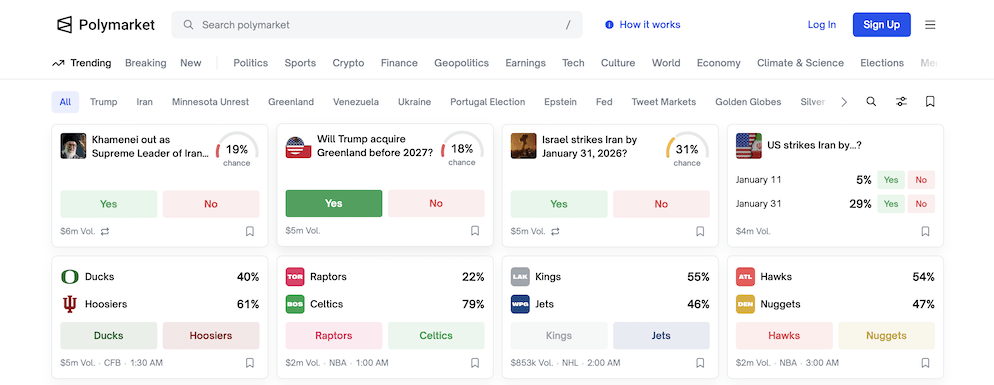

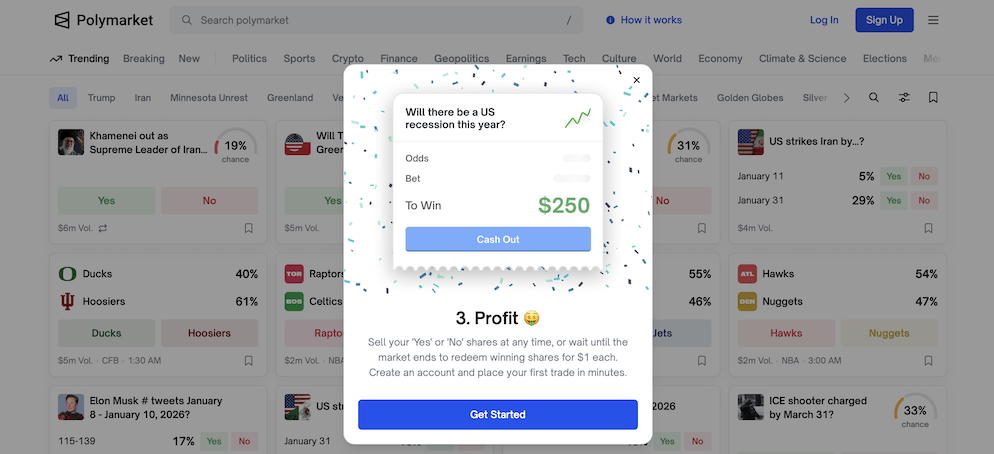

Every market on Polymarket acts as a binary option.

- Yes Share: Pays out $1.00 if the event happens.

- No Share: Pays out $1.00 if the event does not happen.

- The Price: The price of a share reflects the probability. If a “Yes” share costs $0.60, the market believes there is a 60% chance the event will occur.

If you buy 1,000 “Yes” shares at $0.60 (investing $600) and the event occurs, your shares redeem for $1,000. Your profit is $400. If the event does not occur, your shares are worth $0.00.

The Technology Stack: Polygon and USDC

Polymarket’s success is largely due to its friction reduced user experience. By utilizing the Polygon network, the platform minimizes the high “gas fees” associated with Ethereum. Furthermore, all betting is denominated in USDC (USD Coin), a regulated stablecoin. This removes the volatility exposure of betting with fluctuating assets like Bitcoin or Ethereum, making the Polymarket election markets attractive to institutional investors who wanted pure exposure to political outcomes without crypto volatility.

Part 2: The Polymarket Election of 2024

To understand the platform’s current dominance, we must dissect the 2024 Polymarket election cycle. This was the moment the platform transitioned from a niche crypto tool to a mainstream financial oracle.

Beating the Polls

During the 2024 US Presidential race, Trump Polymarket odds consistently diverged from mainstream media polling. While aggregators like FiveThirtyEight often showed a dead heat, Polymarket Trump shares were trading significantly higher in the weeks leading up to the vote.

Critics initially dismissed this as a bias inherent to crypto users, who tend to lean libertarian or right wing. However, the accuracy of the Polymarket election forecast which correctly called the winner and the popular vote nuances early vindicated the platform. It demonstrated that bettors, putting millions of dollars on the line, were reacting faster to on the ground data than traditional pollsters using antiquated methodology.

The “Whale” Phenomenon

The Polymarket election liquidity was massive, exceeding $3.2 billion in total volume. This liquidity allowed for “whales” (large investors) to take massive positions. A notable French trader, known pseudonymously, wagered over $30 million on Trump Polymarket odds, netting a massive profit. This proved that the market could absorb institutional sized capital, paving the way for the platform’s acquisition of QCX and subsequent CFTC regulation in late 2025.

Part 3: Regulatory Rollercoaster & The CFTC

Polymarket’s journey has been defined by its relationship with US regulators.

The 2022 Crackdown

In January 2022, the Commodity Futures Trading Commission (CFTC) fined Polymarket $1.4 million. The charge was operating an unregistered “swap execution facility.” As a result, Polymarket was forced to “geo block” US users. For three years, Americans technically could not access the Polymarket election markets, though many circumvented this via VPNs.

The FBI Raid

In November 2024, shortly after the election was called, the FBI raided the New York home of Polymarket CEO Shayne Coplan, seizing his electronics. The company and its supporters framed this as political retaliation for the Polymarket election markets exposing the weakness of the incumbent administration. This event ironically boosted the platform’s “anti establishment” credibility.

The 2025/2026 Turnaround: Becoming a Regulated Exchange

By late 2025, the narrative shifted. With backing from heavyweights like Peter Thiel’s Founders Fund and Vitalik Buterin, Polymarket acquired QCX and QC Clearing for $112 million. This strategic move allowed them to bypass the need for a new license by buying an existing one. By January 2026, Polymarket had received an Amended Order of Designation from the CFTC, allowing it to operate legally in the US. This legitimized the Polymarket election data as a standard financial metric, akin to the S&P 500.

Part 4: Comparative Analysis Polymarket vs. The Field

While the Polymarket election narrative dominates the headlines, it is not the only prediction market. However, it is the largest. Below is a detailed comparison of how Polymarket stacks up against its primary competitors: Kalshi (the fully regulated US rival) and PredictIt (the academic veteran).

The Prediction Market Landscape

Polymarket

- Technology: Decentralized (Blockchain Polygon)

- Currency: USDC (Crypto Stablecoin)

- Regulation (US): Regulated (via QCX as of 2026)

- Betting Limits: No Limits (High Liquidity)

- Fees: No platform fees (Gas Spread only)

- Market Variety: Infinite (Pop culture, Crypto, Politics)

- Resolution: UMA Oracle (Decentralized Voting)

- 2024 Election Volume: $3.2 Billion+

Kalshi

- Technology: Centralized (Traditional Database)

- Currency: USD (Fiat)

- Regulation (US): Fully CFTC Regulated

- Betting Limits: Variable (up to $100m+ for institutions)

- Fees: Transaction Withdrawal fees

- Market Variety: Federal approved only (Weather, Econ, Politics)

- Resolution: Centralized Data Sources

- 2024 Election Volume: ~$500 Million

PredictIt

- Technology: Centralized (Traditional Database)

- Currency: USD (Fiat)

- Regulation (US): Operate under “No Action” Letter

- Betting Limits: Capped at $850 per contract

- Fees: 10% on profits + withdrawal fees

- Market Variety: Strictly Politics & Econ

- Resolution: Centralized Data Sources

- 2024 Election Volume: <$100 Million

Why Polymarket Wins on Volume

The primary difference lies in the “permissionless” nature of Polymarket’s origins. While Kalshi had to sue the CFTC to list election markets, the Polymarket election pools were already running globally. PredictIt, hampered by an $850 limit per person, cannot attract the “smart money” that drives accurate price discovery. When a Polymarket Trump share moves, it moves because millions of dollars are behind it, creating a stronger signal than the capped bets on PredictIt.

Part 5: Deep Dive into Popular Markets

While the Polymarket election is the flagship, the platform’s utility spans far beyond the White House. The diversity of markets creates a unique SEO footprint and attracts varied demographics.

Polymarket House Control

Alongside the presidency, the Polymarket House control markets are vital for financial traders. Hedge funds use these specific markets to hedge their portfolios. If Polymarket House control odds swing toward Democrats, a trader might short energy stocks; if they swing Republican, they might go long on defense contractors. The granularity of these markets down to individual district races provides data that general polling cannot.

Polymarket Zohran and Local Politics

The platform has become hyper local. Markets involving figures like Polymarket Zohran (referring to Zohran Mamdani in NYC politics) allow local constituents to gauge the viability of mayoral or council candidates. This democratization of betting means that hyper local issues, which national pollsters ignore, get accurate probability assessments.

Barron Trump Polymarket: The Meme Coin Intersection

A bizarre but high volume subset of markets involves the intersection of politics and crypto culture. The Barron Trump Polymarket odds often correlate with the movement of the “DJT” Solana token. Speculators famously bet on whether Barron Trump was officially involved in various crypto projects. These markets highlight Polymarket’s willingness to host niche, culturally relevant topics that regulated rivals like Kalshi would never touch.

Polymarket JFK

Conspiracy theories and historical mysteries also find a home here. Polymarket JFK markets tracked the probability of the Biden or Trump administrations releasing the full, unredacted JFK assassination files. These markets act as a “truth barometer,” allowing the public to bet on government transparency.

Polymarket Government Shutdown

Economic stability markets are crucial for institutional users. Polymarket government shutdown markets predict the likelihood of federal funding lapses. These are essentially insurance products; a government contractor worried about a shutdown can buy “Yes” shares on a Polymarket government shutdown market to hedge their real world financial risk.

Part 6: The Technical Edge Polymarket API and Developers

For the Polymarket election volumes to reach billions, the platform needed more than just a website; it needed algorithmic trading.

The Polymarket API

The Polymarket API is the backbone of the exchange’s liquidity. It allows sophisticated quantitative traders to build bots that arbitrage prices between Polymarket and other exchanges (or even between related markets on Polymarket itself).

- Free Access: Unlike Bloomberg terminals or high end financial data feeds, the Polymarket API is generally free to access.

- High Frequency: The shift to a localized order book (CLOB) allowed the Polymarket API to support high frequency trading strategies, tightening spreads and ensuring that a user buying $100k of Polymarket Trumpshares doesn’t suffer from massive slippage.

- Data Analysis: Data scientists use the API to scrape historical probabilities, comparing Polymarket election odds against actual outcomes to refine predictive models.

Decentralized Resolution (UMA)

A critical technical component is how markets are resolved. If you bet on a Polymarket government shutdown, who decides if it happened? Polymarket uses UMA, an optimistic oracle. Token holders vote on the outcome. If there is a dispute, it escalates to a vote by UMA token holders. This decentralized adjudication was famously tested during the Titan Submersible event and the 2020 election disputes, proving robust even under high pressure.

Part 7: Corporate Structure and Future

Polymarket Careers

As the platform scales into a regulated US exchange, Polymarket careers have become highly coveted in the fintech space. The company is aggressively hiring for roles in:

- Compliance & Legal: To navigate the CFTC framework.

- Engineering: enhancing the Polymarket API and matching engine.

- Market Operations: Designing the specific language for markets like Polymarket JFK or Polymarket House control to avoid ambiguity during resolution.

Working at Polymarket is now seen as bridging the gap between “degen” crypto culture and Wall Street respectability.

Funding and Valuation

Polymarket is not a scrappy startup anymore. It is a unicorn.

- Founders Fund: Peter Thiel’s VC firm led early rounds, validating the platform’s libertarian ethos.

- Vitalik Buterin: The Ethereum creator is an active user and vocal supporter, viewing prediction markets as a primary utility of blockchain.

- ICE (Intercontinental Exchange): In late 2025, the owners of the NYSE invested, valuing the company at nearly $8 billion. This signaled the ultimate institutional acceptance of the Polymarket election model.

Part 8: Ethical Implications and Insider Trading

The power of the Polymarket election model brings risks. The primary concern is insider trading.

In January 2026, a massive controversy erupted involving Venezuela. A trader placed a large wager that Nicolás Maduro would be ousted just hours before US intervention occurred. This trader netted roughly $400,000. While illegal in traditional stock markets, insider trading in prediction markets is legally gray but structurally beneficial: it ensures the price reflects the true probability.

If an insider knows a Polymarket government shutdown is inevitable because they work in Congress, and they bet “Yes,” they are technically making the market more efficient for everyone else. This radical transparency is the platform’s double edged sword.

Conclusion: The Era of Market Based Truth

The Polymarket election of 2024 was the proof of concept. The regulatory approval of 2026 was the graduation. Today, Polymarket stands as a pillar of the new information economy.

Whether you are tracking Barron Trump Polymarket rumors, hedging against a Polymarket government shutdown, or analyzing Polymarket House control odds for your investment portfolio, the platform has made one thing clear: money talks louder than pundits.

As the Polymarket API integrates with more financial institutions and Polymarket careers attract top talent, we are moving toward a world where news is not just reported, but priced. The Polymarket election cycle proved that when the stakes are high, the market is the only pundit worth listening to.

FAQ: Quick Facts about Polymarket

Q: Was the Polymarket election forecast accurate? A: Yes. The Polymarket election odds correctly favored Donald Trump well before mainstream polling aggregators converged, and accurately predicted the popular vote dynamics in key swing states.

Q: Can I use the Polymarket API for betting? A: Yes, the Polymarket API is designed for programmatic trading, allowing users to build bots, execute trades, and pull historical data for analysis.

Q: What happened with the Polymarket JFK market? A: Polymarket JFK markets speculate on the declassification of assassination records. These markets often see spikes in activity around specific anniversaries or government deadlines.

Q: Is betting on Barron Trump Polymarket markets legal? A: Following the CFTC designation in 2026, trading on Polymarket is legal in the US, though specific “novelty” markets like Barron Trump Polymarket odds may face stricter scrutiny than political or economic markets.

Q: How do I find Polymarket careers? A: Polymarket careers are listed on their official portal, with a focus on high performance computing, solidity development, and regulatory compliance officers.