Is Kalshi safe is the first and most critical question for any investor considering entering the world of regulated prediction markets in 2026. The answer is a definitive yes because the platform operates under the strict federal oversight of the Commodity Futures Trading Commission which ensures that all member funds are segregated and that the exchange adheres to rigorous consumer protection laws.

This comprehensive guide serves as the ultimate resource for understanding the Kalshi ecosystem. We will explore the intricacies of its regulatory framework and how it compares to unregulated competitors and the mechanics of its unique financial products. Whether you are looking to hedge against inflation or simply trade on the outcome of the next election this guide provides the clarity you need.

Is Kalshi Safe and Regulated?

The foundation of the platform success lies in its unwavering commitment to compliance and safety. Unlike many offshore betting sites that operate in legal gray areas Kalshi has secured the status of a Designated Contract Market or DCM from the CFTC, which a safe bet the it comes to its legitimacy. This is the same regulatory designation held by the New York Mercantile Exchange and the Chicago Board of Trade.

It means that Kalshi is not just a website but a federally regulated financial exchange that must adhere to the Commodity Exchange Act. This distinction is vital for anyone asking Is Kalshi Safe because it guarantees a level of oversight that is nonexistent in the crypto betting world.

The safety of user funds is paramount in this regulatory environment. To ensure total protection the platform implements several key protocols regarding capital management:

- User funds are strictly segregated from company operational capital meaning your money is never used to pay Kalshi employee salaries or office rent.

- Deposits are held in a specific segregated bank account at a US regulated financial institution which provides a layer of security comparable to traditional brokerage accounts.

- The platform utilizes a clearinghouse model where every contract is fully collateralized ensuring that for every dollar a user stands to win there is a dollar held in escrow from the counterparty.

- This structure eliminates the counterparty risk found in traditional bookmaking where the house might refuse to pay out a large winner during volatile market events.

Another critical aspect of the Is Kalshi Safe discussion involves the prevention of market manipulation. The exchange employs a dedicated surveillance team that monitors trading activity in real time. They look for wash trading and spoofing and other illegal practices that could distort market prices. Because all traders must undergo Know Your Customer or KYC verification Kalshi knows the identity of every participant.

This discourages bad actors and allows the platform to cooperate with federal law enforcement if criminal activity is detected. This level of transparency is a stark contrast to anonymous decentralized platforms where wash trading is often rampant, making Kalshi a safe option.

The legal journey of the company also reinforces its legitimacy. In 2024 Kalshi successfully challenged the CFTC in federal court to win the right to list congressional control contracts. This victory was a landmark moment for the industry establishing that event contracts are a legal financial instrument in the United States.

By operating within the court system rather than ignoring it the founders demonstrated a long term commitment to building a sustainable and legal marketplace. This legal precedent provides additional assurance to traders that the platform is here to stay and is not at risk of being shut down overnight by regulators.

How Kalshi Live Forecast Works

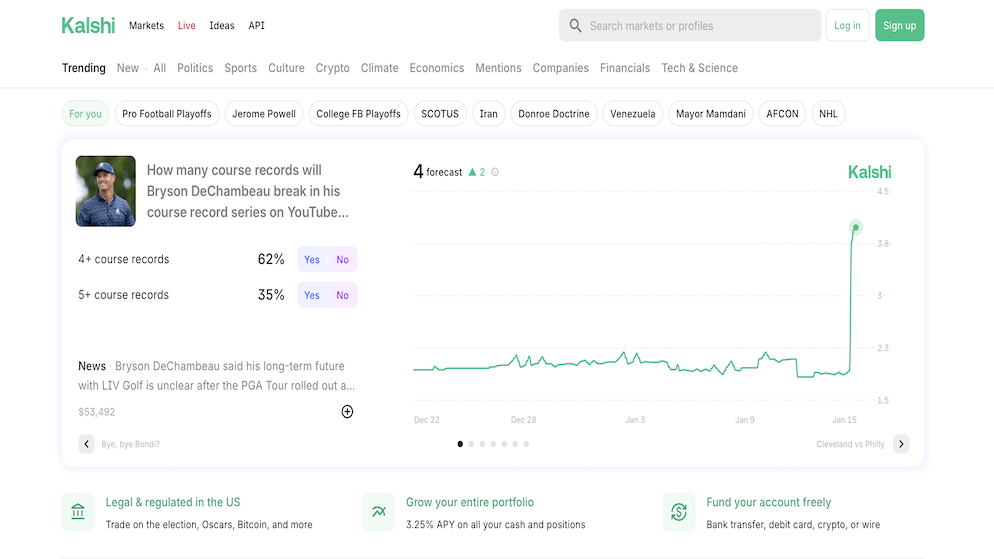

The core value proposition of the exchange extends beyond simple speculation and offers a powerful data tool known as the Kalshi live forecast. Because users trade with real money the prices on the exchange reflect the aggregated wisdom of the crowd. When a contract for a Federal Reserve rate cut trades at seventy cents it implies a seventy percent market probability of that event occurring. This pricing mechanism creates a dynamic and constantly updating Kalshi live forecast that often reacts to news faster than traditional polling or expert analysis.

The mechanics behind the Kalshi live forecast are rooted in the order book model. Unlike a sportsbook where a manager sets the odds the prices on Kalshi are determined entirely by supply and demand. If breaking news suggests that inflation is rising traders will immediately rush to buy contracts predicting a rate hike. This buying pressure drives up the price effectively updating the Kalshi live forecast in real time. For researchers and journalists and investors this data is invaluable. It provides an unfiltered view of what the market actually believes will happen rather than what pundits say might happen.

One of the most compelling examples of whether it is safe and the Kalshi live forecast in action is during election cycles. Traditional polls can be slow to conduct and are often subject to methodology errors. In contrast the Kalshi live forecast aggregates the views of thousands of financially motivated participants.

There are several reasons why this data often outperforms traditional models:

- Traders incorporate a wider range of information including polls and economic data and local news into their decision making process.

- The financial incentive forces participants to trade based on their true beliefs rather than their hopes which eliminates much of the bias found in survey responses.

- The market reacts instantly to breaking news events such as debates or legal rulings whereas polls can take days or weeks to reflect shifts in public opinion.

- The aggregation of diverse participants from retail traders to institutional market makers creates a synthetic probability engine that digests all available public information into a single actionable number.

Traders can also utilize the Kalshi live forecast to identify arbitrage opportunities or mispriced assets in other markets. For instance if the Kalshi live forecast shows a high probability of a severe hurricane season an investor might look at insurance stocks or energy futures that have not yet priced in that risk. The platform facilitates this by offering historical charts that show how the probability of an event has changed over time allowing users to analyze the volatility and trend of the Kalshi live forecast.

The accuracy of the Kalshi live forecast is further enhanced by the diversity of its participants. The market includes a mix of retail traders and institutional market makers and subject matter experts. A meteorologist might trade on weather markets while a political operative might trade on election outcomes. This convergence of specialized knowledge makes the Kalshi live forecast a robust indicator. Whether tracking the Oscars or the Consumer Price Index the Kalshi live forecast provides a signal that is hard to replicate with traditional models.

Kalshi vs Polymarket: Key Differences

The battle for dominance in the prediction market space is often framed as Kalshi vs Polymarket. While both platforms allow users to trade on future events they approach the industry from completely different angles.

The most significant difference in the Kalshi vs Polymarket comparison is the regulatory environment. Kalshi is a US regulated exchange that requires KYC and connects to US bank accounts. Polymarket is an unregulated decentralized platform running on the Polygon blockchain that deals exclusively in cryptocurrency and technically bars US residents from trading.

For the average American trader the Kalshi vs Polymarket choice is often made for them by the law. Accessing Polymarket from the US requires circumvention tools like VPNs which carries legal risk and violates the platform terms of service. Kalshi provides a fully compliant onboarding process that takes minutes and requires no technical knowledge of blockchain wallets. In the context of Kalshi vs Polymarket regarding user experience Kalshi feels like a standard brokerage app like Robinhood while Polymarket feels like a Web3 crypto application.

Another major point of divergence in the Kalshi vs Polymarket debate is the currency used. Kalshi operates entirely in US dollars. You deposit dollars and you trade in dollars and you withdraw dollars. Polymarket requires the use of USDC which is a stablecoin. This means Polymarket users must first purchase crypto on an exchange and transfer it to a wallet and then bridge it to the Polygon network. For crypto natives this is trivial but for the general public it is a significant barrier to entry that gives Kalshi a distinct advantage in the Kalshi vs Polymarket rivalry.

Market variety is another area where the Kalshi vs Polymarket comparison yields interesting results. Because Polymarket is unregulated it can list virtually any market instantly without approval. This allows for very niche or controversial markets to appear. Kalshi must certify its markets comply with the Commodity Exchange Act which historically slowed its listing process.

However with recent legal victories Kalshi has expanded aggressively into sports and politics closing the gap. When looking at liquidity Kalshi vs Polymarket often depends on the specific event but Kalshi benefits from institutional market makers who are comfortable operating in a regulated environment making it far more safe.

Kalshi vs Polymarket Head to Head Table

| Feature | Kalshi | Polymarket |

| Regulation | CFTC Regulated (US Legal) | Unregulated (US Restricted) |

| Currency | USD (Fiat) | USDC (Crypto) |

| Deposit Methods | ACH, Wire, Bank Transfer | Crypto Wallet Transfer |

| Fees | Trading fees apply (varies by market) | No trading fees (Network gas fees apply) |

| Safety | Funds segregated in US banks | Smart contract risk |

| Taxes | Issues Form 1099 B | User must self report |

| Mobile App | Native iOS and Android App | Web Browser Only (Mobile Web) |

| Sports Markets | Yes (NFL, NBA, MLB, etc.) | Yes (Soccer, Tennis, US Sports) |

Ultimately the Kalshi vs Polymarket decision comes down to risk tolerance and location. If you value a safe environment, legal compliance and ease of use Kalshi is the superior choice. If you are outside the US and prefer the anonymity of DeFi Polymarket may appeal to you. However for mass adoption the Kalshi vs Polymarket battle is likely to be won by the platform that integrates seamlessly with the traditional financial system.

Kalshi Stock & Market Mechanics

Investors are increasingly asking about Kalshi stock and how they can gain exposure to the growth of this financial powerhouse. It is important to clarify that Kalshi remains a privately held company. This means you cannot simply open a brokerage account and buy Kalshi stock on the NASDAQ or NYSE. The company is backed by some of the most prestigious venture capital firms in the world including Sequoia Capital and Paradigm. These investors hold the majority of Kalshi stock alongside the founders and early employees.

The valuation of Kalshi stock has soared in private markets following its expansion into sports betting and its victory against the CFTC. In late 2025 the company raised a Series E round that implied a valuation of roughly eleven billion dollars. This places the value of Kalshi stock among the highest in the fintech sector. While retail investors cannot buy Kalshi stock directly there is persistent speculation about a future Initial Public Offering.

An IPO would allow the general public to purchase Kalshi stock and participate in the company financial success. Until then access to Kalshi stock is restricted to accredited investors via secondary private equity marketplaces.

Understanding the market mechanics is crucial for anyone trading on the platform or interested in Kalshi stock potential. The exchange operates on a binary option model where every contract pays out either one dollar or zero dollars. This simplicity is a key driver of user adoption. The contracts are priced between one cent and ninety nine cents representing the probability of the outcome.

If you buy a contract at sixty cents and it pays out one dollar you make a forty cent profit. This creates a clear risk reward profile that is easy for beginners to understand and attractive to the investors backing Kalshi stock.

The platform charges trading fees which are the primary revenue source driving the value of Kalshi stock. These fees are generally lower than the vig charged by traditional sportsbooks. The fee is calculated based on the maximum potential earnings of a trade and is displayed transparently before execution. This volume based revenue model means that as more users flock to the platform to trade on elections or economics the revenue grows which in turn increases the theoretical value of Kalshi stock.

Kalshi offers a wide range of market categories that go beyond simple binary options. To better understand the ecosystem we can categorize the available markets into four primary pillars:

- Economic Markets: Traders can speculate on the exact numbers for CPI inflation and GDP growth and Federal Reserve interest rate decisions which are popular tools for hedging stock portfolios against macro risks.

- Political Markets: Following the legal victory users can trade on control of Congress and the presidency and even specific margin of victory outcomes providing a real time sentiment gauge for elections.

- Weather Markets: These allow businesses to hedge against temperature extremes or hurricane landfalls effectively protecting revenue against climate risks in specific cities.

- Entertainment Markets: Markets for the Oscars and Grammys and Rotten Tomatoes scores allow pop culture enthusiasts to monetize their predictions regarding box office performance and award winners.

The robust infrastructure supporting these markets is what gives institutional investors confidence in Kalshi stock. The exchange uses a central limit order book rather than an automated market maker. This means users trade directly with one another or with institutional market makers. This peer to peer structure ensures fair pricing and allows for deeper liquidity which is essential for attracting the high net worth traders who might one day become holders of Kalshi stock post IPO.

Kalshi Support & Security

A robust customer experience is vital for a regulated exchange and Kalshi support is structured to provide timely and accurate assistance. Unlike decentralized platforms where help is often non existent Kalshi support is staffed by real humans based in the United States. Users can reach out to Kalshi support via email for account specific inquiries such as verification issues or funding delays. The feedback regarding Kalshi support has generally been positive with users appreciating the professional tone and regulatory knowledge of the staff.

In addition to direct communication Kalshi support maintains an extensive Help Center. This database covers everything from tax reporting to explanation of settlement rules. It is highly recommended to consult these articles before contacting Kalshi support as they often contain the immediate answers to common questions. For more complex issues involving trade disputes or compliance questions Kalshi support has a dedicated escalation process to ensure that matters are reviewed by senior compliance officers.

Security is the other side of the coin and the platform technical infrastructure is enterprise grade. The company has implemented a comprehensive suite of security protocols to ensure the integrity of the ecosystem:

- SOC 2 Compliance: Kalshi adheres to SOC 2 Type II compliance standards which is the gold standard for data security ensuring that user data including social security numbers is encrypted.

- Two Factor Authentication: The platform employs mandatory two factor authentication or 2FA for all accounts adding an extra layer of protection against account takeovers and unauthorized access.

- AML and KYC Protocols: Financial security is reinforced by strict anti money laundering and identity verification protocols that verify every user to prevent fraud and maintain a clean trading environment.

- Encrypted Data Transmission: All financial and personal data transmitted between the user app and Kalshi servers is protected by advanced encryption standards to prevent interception.

There have been instances discussed online where users experienced delays during high traffic events like election nights. In these moments Kalshi support can experience higher than normal volumes leading to slower response times. However the company has invested heavily in scaling its server infrastructure to minimize downtime. The reliability of the platform is a key focus for the engineering team as they know that trust is the currency of a financial exchange. Users who encounter technical bugs are encouraged to report them to Kalshi support immediately so they can be patched.

The intersection of Kalshi support and whether it is safe is perhaps most visible in the withdrawal process. To prevent fraud Kalshi support may manually review large withdrawal requests or those to new bank accounts. While this can add a slight delay it is a necessary security measure to ensure that funds are being returned to the rightful owner. This attention to detail reinforces the answer to Is Kalshi Safe by demonstrating that the platform prioritizes asset protection over speed when necessary.

What Reddit Users Say About Kalshi

The Kalshi reddit community is one of the most active and honest sources of user feedback on the internet. Browsing the Kalshi reddit threads reveals a mix of sophisticated trading strategies and platform critiques and feature requests. For a new user the Kalshi reddit sub is an invaluable resource for learning the ropes and understanding the real world experience of trading on the exchange.

One of the most frequent topics on Kalshi reddit is the comparison of odds between different platforms. Users often post screenshots showing arbitrage opportunities where the Kalshi live forecast differs from other sources. The sophisticated nature of the Kalshi reddit user base means that discussions often delve into complex probability math and hedging strategies. It is not essentially a place for memes but rather a forum for serious traders to exchange ideas.

However the Kalshi reddit community is not shy about voicing complaints. A recurring theme on Kalshi reddit involves the desire for lower fees on low priced contracts. Users have argued that the fee structure can make it difficult to profit on long shot bets. The Kalshi team appears to monitor Kalshi reddit as there have been instances where platform updates directly addressed concerns raised in the top threads. This feedback loop between the company and the Kalshi reddit community has helped shape the product over time.

To summarize the general discourse found on the platform here are the key themes that dominate Kalshi reddit discussions:

- Fee Structure Critiques: Traders frequently debate the impact of fees on lower probability contracts and suggest improvements to the pricing model.

- Settlement Speed: Users actively track and report on how quickly markets settle after an event occurs often comparing it to competitor speeds.

- Market Requests: The community uses the forum to formally request new market types particularly in the sports and international politics categories.

- Tax Implications: There are numerous threads dedicated to understanding Form 1099 B and how to properly report earnings to the IRS.

- Interface Feedback: Users often provide detailed feedback on the mobile app UI suggesting features like dark mode or better charting tools.

The expansion into sports betting was a major event for the Kalshi reddit community. Prior to the launch there was intense speculation on Kalshi reddit about which sports would be included and how the liquidity would compare to traditional sportsbooks. Since the launch the sentiment on Kalshi reddit has been largely positive regarding the interface although some power users have requested more granular prop bets. The ability to trade sports legally without the vig of a sportsbook is a major selling point frequently cited by Kalshi reddit members.

Overall, the sentiment found on Kalshi reddit is that of a growing and engaged community that believes in the future of prediction markets. While they are critical of technical hiccups and fee structures the users on Kalshi reddit generally prefer the regulated environment of Kalshi over offshore alternatives. For anyone looking to get the unvarnished truth about the platform and making sure that it is safe, joining the Kalshi reddit community is a must.

Final Thoughts

The rise of Kalshi represents a fundamental shift in the financial landscape. By bringing event contracts into the regulated US market the platform has answered the question Is Kalshi safe with a resounding affirmative. It offers a secure and transparent and legal way for individuals to monetize their knowledge and hedge against real world risks.

With its valuation skyrocketing and its product offering expanding into sports and politics Kalshi is well positioned to become a central pillar of the modern financial system. Whether you are a data nerd analyzing the Kalshi live forecast or an investor waiting for Kalshi stock to go public the platform offers something for everyone.

While challenges remain in terms of educating the public and refining the user experience the foundation has been laid for a new era of interactive finance. As always conduct your own research and never trade with money you cannot afford to lose.

Frequently Asked Questions (FAQs)

Is Kalshi safe? Is it gambling or investing? From a legal standpoint Kalshi is trading not gambling. It is regulated by the CFTC as a financial exchange. However the risk profile is similar to high risk investing or gambling. You can lose your entire principal if your predictions are wrong.

What happens if a market outcome is disputed? Kalshi has a rigorous settlement process based on independent data sources. If a dispute arises the exchange has a predefined set of rules to determine the outcome. In rare cases where data is ambiguous the market may be voided and funds returned.

Can I trade on Kalshi on the weekends? Yes trading is available twenty four hours a day seven days a week. Unlike the stock market which closes on weekends Kalshi markets remain open allowing you to react to breaking news instantly.

Is there a mobile app for Kalshi? Yes there is a fully functional mobile app available for both iOS and Android devices. The app offers the full functionality of the desktop site including depositing funds and placing trades and viewing charts.

How does Kalshi make money? Kalshi generates revenue by charging transaction fees on trades. They do not take the other side of the trade meaning they are indifferent to whether you win or lose. Their goal is simply to facilitate volume.