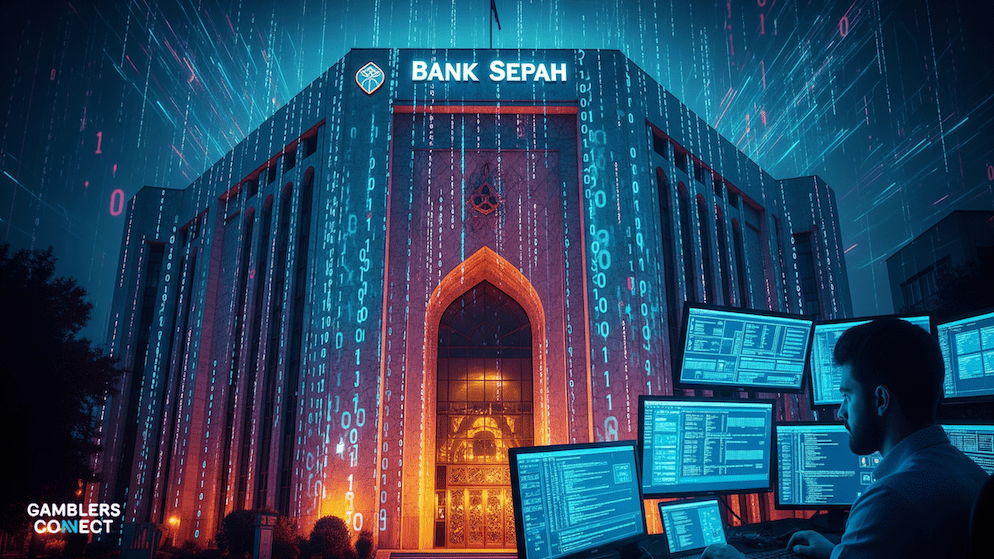

One of Iran’s oldest and most significant financial institutions, Bank Sepah, has been crippled by a devastating cyberattack, resulting in the reported erasure of all its databases, a complete shutdown of its ATM network, and a widespread inability for customers to access their funds.

The attack, which unfolded in mid-June 2025, has sent shockwaves through the nation’s financial sector and serves as a stark illustration of the inherent vulnerabilities within centralized banking systems.

The hacktivist group “Predatory Sparrow,” which has alleged ties to Israel, has claimed responsibility for the breach. In a public statement, the group asserted that it had “destroyed all data” belonging to the bank, which is closely linked to Iran’s military.

The immediate aftermath saw extensive service disruptions that have persisted, leaving customers in a state of uncertainty and without access to their own money for days.

This event has actualized a nightmare scenario for proponents of traditional, centralized finance. The incident at Bank Sepah demonstrates with alarming clarity how the financial well-being of millions can be held hostage by the cybersecurity integrity of a single institution.

When that single point of failure is compromised, the cascading effects are immediate and severe, effectively freezing a vast pool of assets and grinding economic activity to a halt for those affected.

For days following the attack, reports from across Iran depicted a chaotic situation, with customers unable to perform basic transactions or withdraw cash. The disruption underscores a critical lesson in the digital age: reliance on a centralized intermediary for the custody of one’s wealth carries profound systemic risks.

This crisis has ignited a fervent discussion on the merits of decentralized financial systems. Proponents of cryptocurrencies argue that this is precisely the vulnerability that technologies like Bitcoin were designed to solve.

The principle of self-custody, a cornerstone of the Bitcoin ethos, offers a powerful counter-narrative to the events unfolding at Bank Sepah.

When an individual holds the private keys to their own Bitcoin, they are not dependent on any third-party institution for access to their funds. A cyberattack on a bank or any other centralized entity cannot freeze or erase its wealth.

The distributed nature of Bitcoin’s blockchain technology provides a level of resilience that centralized databases inherently lack. By decentralizing the ledger, there is no single point of attack that can simultaneously compromise the entire system and disenfranchise its users.

The customers of Bank Sepah are now learning this lesson in the most difficult way imaginable. Their experience highlights the potential appeal of a financial system where control is returned to the individual.

The ability to hold one’s own assets, impervious to the security failings of a trusted institution, is a compelling proposition in an era of escalating digital threats.

While traditional banking has long been the bedrock of global finance, its systemic vulnerabilities are becoming increasingly apparent, prompting a re-evaluation of where individuals choose to place their trust and their wealth.